Table of Content

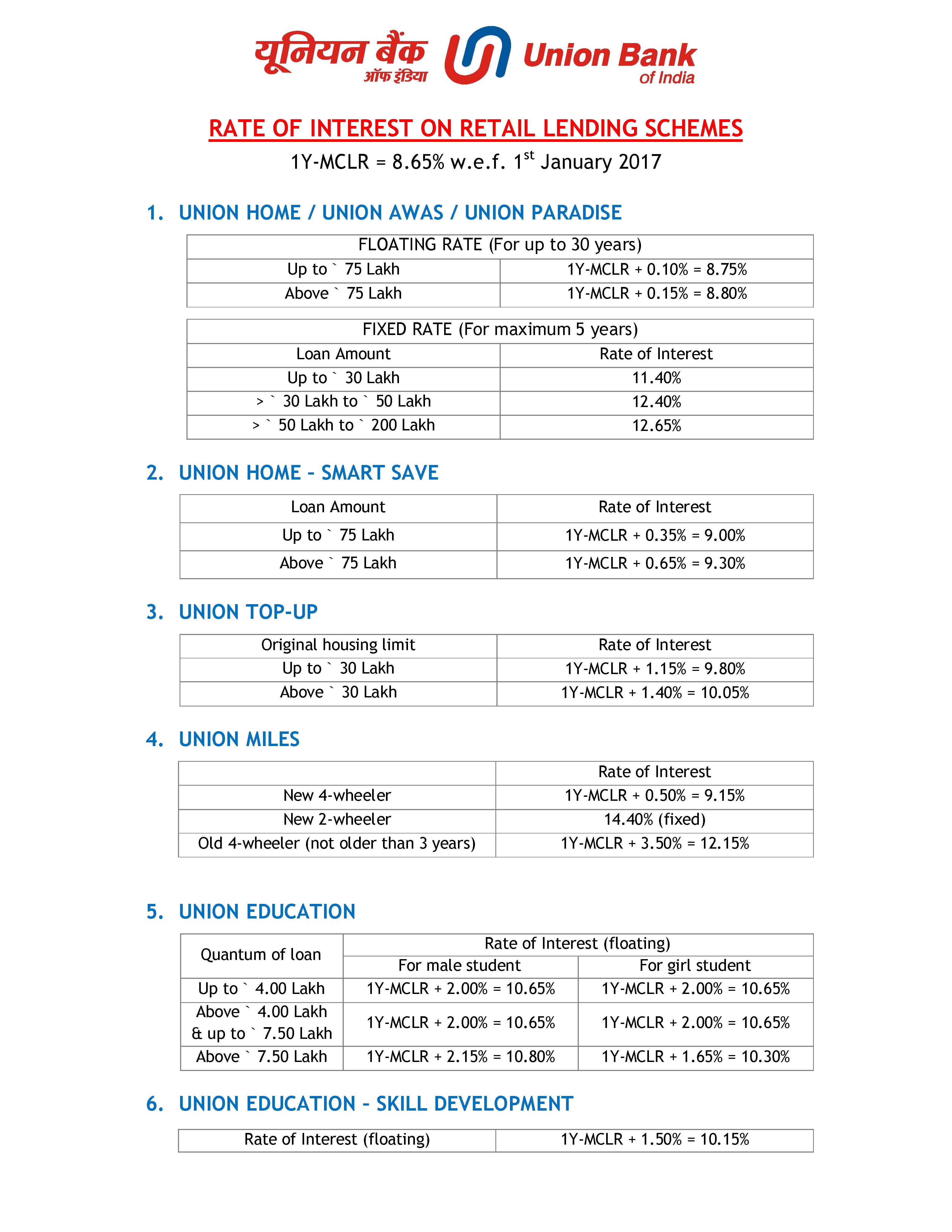

Bank of Baroda Home Loan- The minimum processing fee in percentage is 0.25% and the minimum processing fee amount is Rs.8,500. Bank of India Home Loan- The minimum processing fee in percentage is 0.25% and the minimum processing fee amount is Rs.1,500. YES Bank Home Loan- The minimum processing fee in percentage is 2% and the minimum processing fee amount is Rs.10,000.

Adhil Shetty of BankBazaar.com says that since inflation is moderating, the rates are somewhere close to their peak. He advises prepaying home loans based on availability of funds since this can shorten the ballooning loan tenor. Monga of BASIC Home Loan recommends revising the repayment plan to manage the increased EMI burden. This can be done by opting for a longer tenure loan to reduce the EMI burden, he says. "In such scenarios, the borrower would pay a higher total interest amount, but his EMIs would remain the same. It would help the borrower with their cash flow monthly," Monga tells TOI. If you already own a piece of land and would like to build your dream home on the same, you can consider a home construction loan.

Affordable Housing to be most impacted due to hike in interest rates: Atul Monga, CEO, Basic Home Loan

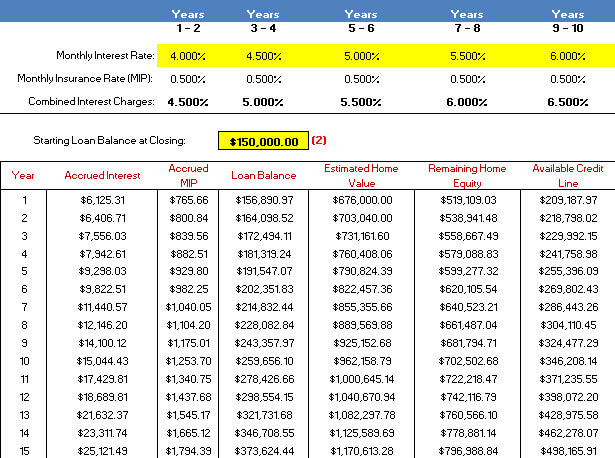

The EMI interest components fluctuate with the Repo Rate movement, and the applicable interest rate is reset. The chart expresses the annual principal and interest paid for the home loan with regular EMIs. As per the extant tax laws governed by the Income Tax Act, 1961, both the home loan principal and the interest repaid during the financial year are eligible for tax deduction under Sections 80C, 24, 80EE, and 80EEA, respectively. Bank of India Home Loan EMI Calculator is best used fruitfully to compare similar EMIs offered by different leading banks. Comparison is ideally made by trying out varying inputs in contrasting permutations and combinations for an accurate appraisal. Sudhir Kaushik of Taxspanner.com tells readers how they can optimise their tax by rejigging their income and investments.

The recent RBI regulations are more focused on payments businesses for regulating BNPL players. ICICI hiked the ICICI Bank External Benchmark Lending Rate (I-EBLR) to 9.10% p.a.p.m. effective from August 5, 2022. The announcement was made just a few hours after the Reserve Bank of India hiked the key policy rates by 50 basis points.

HDFC corners 15% of CLSS housing market with Rs 67k crore loans, Rs 7,200 crore in subsidy payout

Vaidyanathan said that with digitisation, fudging of identity documents and bank statements has come down. “Earlier, banks monitored the loan portfolio every month, while now they can do it on a real-time basis. At every stage, the ecosystem is dramatically changing,” said Vaidyanathan. A house loan or home loan simply means a sum of money borrowed from a financial institution or bank to purchase a house. Home loans consist of an adjustable or fixed interest rate and payment terms. With so many factors affecting the housing loan interest rate in India, such as income, loan amount, employment type, CIBIL score, etc., customers can rest assured that they can improve their eligibility for a lower interest rate.

The borrowers in turn are left with the option of extending the tenure of their loans or increasing the payout of the equated monthly installments. If you are a home loan borrower, then RBI's rate hikes since May this year would have impacted either your loan EMIs or its tenure. Others are wondering if they should extend the tenure or find the money for higher EMIs. We explore how the rate increase has impacted borrowers and what they should do now. Recently, Suryoday Small Finance Bank has hiked the rates of their FDs. You can get anywhere from 4% for a short-term FD to 9.01% for an FD in years.

You will soon have access to paperless home loans

"By doing this, the total interest paid by the borrower would be higher, but the EMIs would remain the same. This would give the borrower some breathing room, in terms of their monthly cash flow," he explains. At that point, the borrower's EMI will also go up because theoretically, the rate hike would create an absurd situation where a 20-year loan can become a 60-year loan. The interest rates for home loans can be fixed or floating, or partly fixed and or partly floating, suiting the needs of the borrower. The property is mortgaged to the lender as a security till the repayment of the loan.

This is typically a small amount that varies by bank and typically costs between 0.5 percent and 2.50 percent of the total loan amount. Every bank sets a minimum and maximum percentage of loan processing fees that the borrower is responsible for paying. You have the option of paying the fee upfront or having it taken from the loan amount when it is disbursed.

Axis Home Loan- The minimum processing fee in percentage is 1% and the minimum processing fee amount is Rs.10,000. HDFC Home Loan- The minimum processing fee in percentage is 0.5% and the minimum processing fee amount is Rs. 3,000. Some banking institutions, on the other hand, either do not charge a processing fee or waive it as part of a special offer.

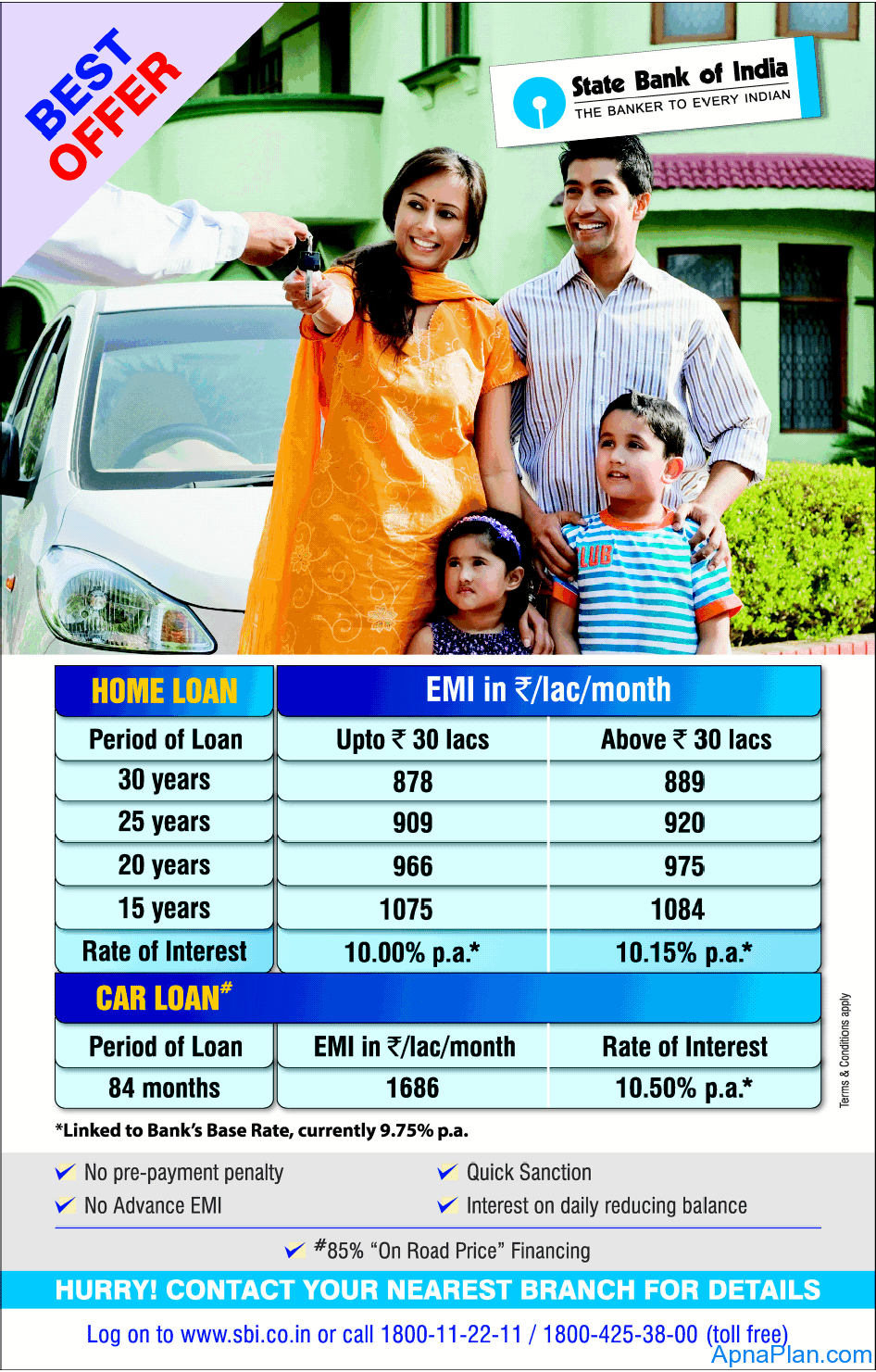

According to Anarock’s research, in 2014, the market sold 3.34 lakh units, a... Bank of India hiked RBLR , with effect from August 5, 2022, to 8.25 percent as per the revised repo rate (5.40%). Bank of India applies only the floating interest rate on their home loan products daily, reducing balance at monthly rests. Effective June 15, 2022, the bank’s EBLR is 7.55%+CRP, as per the SBI website. However, depending on the credit score, a risk premium will be charged.

According to Vivek Iyer, Partner and Leader, Financial Services Risk, Grant Thornton Bharat, loan EMIs will rise further in the near future. Every lender charges you interest on the total principal home loan amount you borrow from them. This interest amount is calculated on the basis of a percentage figure called the home loan interest rate.

After nearly 2.5 years, FD rates are finally becoming attractive again. If you are looking for low-risk and decent returns, this might be a good opportunity. After the Rserve Bank of India hiked the repo rate by 50 basis points to tame the inflation, the banks and NBFCs announced the hike in home loan interest rates charged by them. With the hike in home loan interest rate by 50 bps by HDFC Ltd. here's how much your EMI will rise.

No comments:

Post a Comment