Table of Content

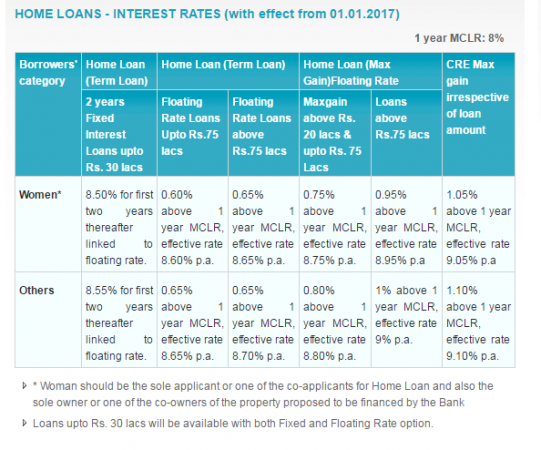

Check out the table below for the current home loan rateson offer, subject to your credit score. Bandhan Bank Home Loan- The minimum processing fee in percentage is 0.25%. South Indian Bank Home Loan- The minimum processing fee in percentage is 0.5% and the minimum processing fee amount is Rs.5,000. Aditya Birla Home Loan- The minimum processing fee in percentage is 0.5%.

In the table below, BankBazaar.com illustrates what has been the likely impact of the 190 basis points repo rate hike so far this year on Rs 50 lakh home loan EMIs. Additionally it looks at the possible hike in EMI if the repo rate is raised by another 50 basis points this fiscal year. Interest rates may be close to peaking as experts see the RBI putting a stop to repo rate hikes in the coming months. The minimum home loan interest rate applicable to you is often subject to market conditions and other factors such as the applicant’s income, type of employment, credit score, home loan amount, type of interest opted for, etc.

DLF sales bookings rise 62% to over ₹4,000 crore

The bank had crossed the Rs 5 lakh crore mark in January 2021, the bank said in a statement, adding it is the first lender to achieve the Rs 6 lakh crore milestone in the residential home category. Home loan rates have risen sharply in the past fi ve months, from 6.5% to 8.25%. A 20-year home loan taken in 2019 at 6.7% will get repaid in 21 years, even though EMIs have been paid for three years. Macrotech Developers, which sells its properties under the Lodha brand, is one of the leading real estate firms in the country.

This will stress the budgets of home loan owners and impact their discretionary spends, he says. Every time the RBI raises repo rate, the banks pass on the hike to consumers in the form of a higher rate of interest. Only banks registered under the scheme are eligible to offer this subsidised loan. If you are a first-time property owner and looking for a lender, do consider one that is registered under this PMAY scheme to avail of the benefit.

Repo rate hikes hit home loan household budgets. Have EMIs peaked?

NESL provides a digital documentation execution service for banks that enables contracts to be made electronically. There are also certain tax benefits available on your home loan under the Section 80EE of Income Tax Act. However, the Income tax deduction can be claimed on home loan interest by first time home buyers only. People generally take a home loan for either buying a house/flat or a plot of land for construction of a house, or renovation, extension and repairs to the existing house.

"Similarly, if you prepay one additional EMI every year, the loan can be closed in 17 years. If you increase the EMI by 5% every year, the loan can be finished in less than 13 years," Shetty says. But before transferring your Home Loan, do consider the actual savings as the new lender might have costs like processing fees and more. If you have already taken a Home Loan and are repaying it now, you have the option to switch to a different lender. Borrowers generally do this in cases where they can get a Home Loan from a different lender at a lower interest rate. If you meet the eligibility criteria for the loan, the lender can approve up to 80%-90% of the cost of the property as a Home Loan.

Home Loan Interest Rate for Amount up to 35 Lakh

As the outcome is displayed, clicking on the EMI details generates the Amortization Schedule for the same inputs. The Amortization Table represents the EMI payment spread over the entire loan tenure helping the applicant use the information for multiple purposes. The EMI components are individually displayed as the Principal and Interest repaid every month or the cumulative annual total. After every EMI credit, the outstanding loan balance helps the applicant chart prepayment to impact the home loan financials.

Based on the findings of the Keki Mistry report, the regulator has proposed phasing out share buybacks from the open market through stock exchanges as these are prone to misuse. An existing home loan can also be enhanced through a top-up loan to fund additional work. Seventy-five years after Independence, 7.2% of India's population owns a passport with a majority having availed one in the past decade.

PNB hikes home loan interest rates: How much your EMI will increase

Several modes are available to the Bank of India home loan borrower for the timely payment of the EMI. The usual modes are using post-dated cheques, ECS, or simply transferred from the account either manually or online, whichever is convenient. During its MPC meeting on Friday, the Reserve Bank of India increased the repo rate by 50 basis points to 5.40 percent. The benchmark prime lending rate of LIC Housing Finance has been modified . The new interest rates on home loans go into effect on September 20, 2022. The CMI reached 99 in June 2022, a level last seen in December 2019 before the pandemic hit the world.

Bank of India Home Loan EMI Calculator multiple times to match the applicant’s financial status. The following table represents the outcome with the range of inputs to help the applicant proceed with the proposed home loan. According to Crisil, this market share trend is unlikely to change in the near term. The recent merger between pure-play home financier HDFC with HDFC Bank will only bolster the trend, the agency noted.

Your monthly EMI for your mortgage is determined by the interest rate on your housing loan. The repo rate of the RBI has been chosen by the majority of banks as their external benchmark. Repo Rate Linked Lending Rate is the name for the lending interest rate that is linked to the repo rate .

India's home loan market, currently valued at Rs 24 trillion, is projected to double in five years. The bank said it is making retail loans cheaper to bring in cheer among customers during the festive season. Home loans from the bank will now be available at 8% per annum while the personal loan rate becomes cheaper at 8.9% from earlier 11.35%. Even with revised EMIs, the fixed obligation to income ratio is expected to increase by less than 10 percentage points and hence remain manageable, unless the original loans were given at aggressive FOIRs.

Axis Home Loan- The minimum processing fee in percentage is 1% and the minimum processing fee amount is Rs.10,000. HDFC Home Loan- The minimum processing fee in percentage is 0.5% and the minimum processing fee amount is Rs. 3,000. Some banking institutions, on the other hand, either do not charge a processing fee or waive it as part of a special offer.

The Tata Group is in final negotiations to buy a majority stake in India’s eighth-biggest mutual fund, UTI Asset Management Co , from four state-owned financial entities, according to people close to the development. If a home owner, at a later date, wishes to extend the usable space of the existing house, they can take a home extension loan. This usually involves structural changes to the house to create more space.

No comments:

Post a Comment